In an uncertain and rapidly changing world, the grocery industry works hard to stay ahead of the shifting needs and demands of consumers. While foresight and planning are important to the changes related to our “new normal,” it is also essential to look inward at the values and strengths an organization possesses and can continue to offer to the marketplace. Though consumer behavior is transforming, the demand for affordable, nutritious, delicious, and sustainable farmed Atlantic salmon remains steady—and Chile is meeting that demand. We’re proud to share the case for Chilean salmon, and to share market research that will help drive sales and potentially increase consumer confidence in our product while we all feel our way forward.

The Case For Chilean Salmon

Chilean salmon is raised in the pure Antarctic waters of Patagonia, and the producers of Chilean salmon are stewards of this remarkable ecology. As the second largest salmon producer in the world, the Chilean salmon industry brings a high-quality, reliable supply of nutritious fish to market year round. Even during times of change, the Chilean salmon industry remains steadfast in its core principles:

- To perform with honesty and integrity in the best interests of consumers, members, and the environment.

- To create increased value for consumers, retailers, foodservice operators, and members.

- To promote healthy food for a healthy life—to always be wellness oriented.

Through good and bad, Chilean salmon producers have worked to assure the U.S. market is well served. While market conditions these past two months have been hard to predict, the fundamental pillars of Chilean salmon growth remain strong:

- Ideally located in the Patagonian region of Southern Chile, the very tip of South America with some of the cleanest fresh water in the world, is an ice-cold saltwater environment fed by the Antarctic and driven by the Humboldt Current.

- Technologically advanced from an operational and ecological perspective—including advanced freshwater hatcheries, environmentally conscious saltwater rearing, and some of the most advanced and hygienic processing facilities in the world.

- Highly regulated via stringent federal oversight by the Chilean government and unrivaled internal controls; no other country compares.

- Responsibly Managed with dramatic reduction since 2015 in antibiotic usage resulting in increased salmon health, wellness, and survival.

- Extremely consistent in producing highly nutritious, delicious, hygienically processed fresh and frozen salmon.

Chile is a leading global producer of salmon; and remains the number one supplier of farmed salmon to the U.S. market. Approximately 50% by weight of salmon imported into the U.S. comes from Chile. The industry is honored to be America’s preferred country of origin and is very proud of this fact. Research is continually gathered to help us better understand consumer behavior and the factors that drive overall sales growth and market position. Chilean salmon farmers believe that responsible aquaculture is the future of marine proteins and remain committed to developing and operating the most efficient, safest, and most environmentally sustainable model possible. This requires continuous, measurable improvement in aquaculture practices and mindful preservation of the natural resources employed during production of high-quality salmon.

- Highly regulated via stringent federal oversight by the Chilean government and unrivaled internal controls; no other country compares.

- More sustainable than ever—with dramatic reduction since 2015 in antibiotic usage resulting in increased salmon health, wellness, and survival.

- Extremely consistent in producing highly nutritious, delicious, hygienically processed fresh and frozen salmon.

Seafood Eaters and Consumer Research

More than ever, consumers are interested in foods that support a healthy diet and bolster their immune system. Further, with purchase dollars moving from foodservice to grocery, retailers are working overtime to ensure demand can be met. As the nation shifts from dining out to eating in, consumers seek ingredients they feel they can easily and successfully prepare at home. Whether frozen or fresh, farmed salmon is the perfect choice. Farmed salmon is highly nutritious and offers a range of healthful benefits. It is the most sustainable of all animal proteins, and is highly forgiving in the kitchen. Compared to other seafood, it can be simply and easily prepared by a home cook. Evidence is found in the ongoing demand for salmon nationally.

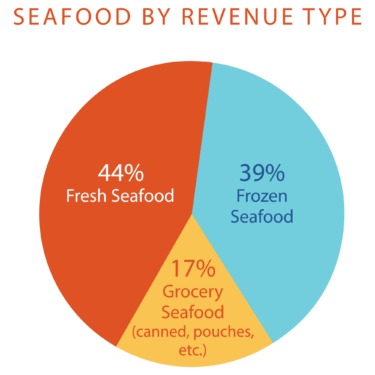

The FMI, in collaboration with IRi Worldwide and Nielsen, reports in “Power of Seafood 2020” that during the 12 months ending September 2019, seafood sales grew 4% in the U.S. This exceeded produce (2.6%), meat (1.9%), and deli (2.0%). As has been the case in prior years, when it comes to seafood, the performance of fresh exceeds frozen with grocery seafood (cans, pouches), a distant third. Consumers clearly prefer fresh, and this is even more evident when it comes to salmon.

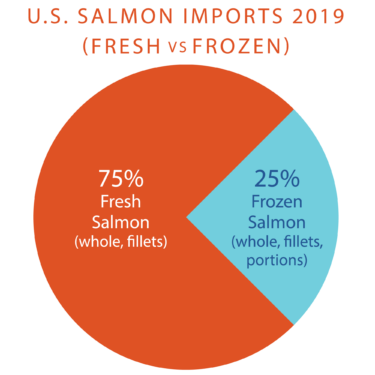

Chilean salmon industry data suggests a compound annual growth rate in salmon consumption of 5% from 2009 until 2019 (1.75x growth). In 2009, consumers enjoyed 2.02 lbs. of farmed Atlantic salmon per capita. By 2019, that number increased to 3.52 lbs. per capita. That’s well over a billion pounds of farmed Atlantic salmon consumed in 2019. Today, fresh accounts for three-quarters of U.S. salmon imports and is a driver of sales growth. Atlantic salmon is the number one fish sold in the U.S. and is truly an American favorite. The data is impressive, and consumer research is ongoing. The more we know about consumer sentiment, the better we are able to meet consumer needs.

During the third quarter of 2019, the Chilean salmon Marketing Council (CSMC) commissioned a national study of U.S. consumer attitudes, perceptions, and reasons for eating seafood, including salmon. A 10-minute online quantitative survey was developed targeting U.S. adults who were seafood eaters. A “seafood eater” is defined as someone who eats seafood at least twice per month. Half of the participants in our survey (53%) reported eating seafood at least weekly. More than half (60%) of seafood eaters say they typically eat salmon. When it comes to farmed vs. wild salmon, 54% of eaters have no preference, or prefer farmed fish.

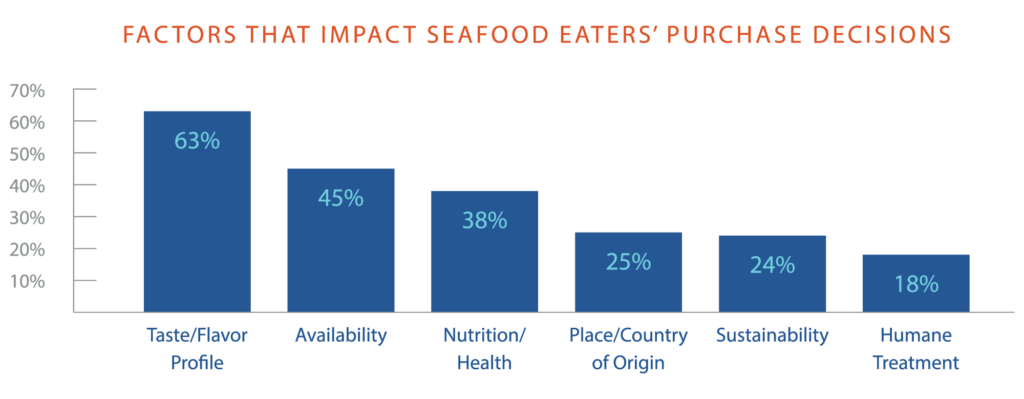

Seafood purchase decisions are impacted by several factors. Seventy-one percent of seafood eaters reported price as the number one factor, followed by taste, availability, nutrition, and place of origin.

When it comes to salmon, our data indicates that nutritional value is far more important for purchasing farmed salmon than fish in general (67% vs. 38%), and second only to price. So long as supply remains stable and prices affordable, consumers will seek farmed salmon to meet their nutritional needs. The Chilean salmon industry stands ready.

What the Future Holds

Now more than ever, Chile will continue to produce a high-quality and consistent product. Promotion of Chile as a country of origin and the nutritional benefits of salmon consumption are ongoing, as is the continuous improvement to assure the long-term viability and success of the industry. This includes partnerships with global organizations like the Global Salmon Initiative, and external review and certification by organizations like the nonprofit Aquaculture Stewardship Council and the Global Seafood Alliance. Third-party collaboration will continue with Monterey Bay Aquarium’s Seafood Watch as the industry reduces antibiotic usage. Though much has changed in the world these past few months, the priorities of the Chilean salmon industry remain the same—a commitment to perform with honesty and integrity in the best interests of consumers, members, partners, and the environment. During good and bad times, this is something that will not change.